Why buy diamond – Lesson 1

You must have heard many times how high your public debt is. Think about it: the wealth possessed by all of you is many times greater, but the wealth is usually concentrated in real estate.

Only now that the difficult years are behind us, each of us is beginning to understand the importance of having a diversified portfolio of our savings. A solution that is spreading more and more, as it is the most valuable commodity in the world, is diamonds.

To buy diamonds there are no alternative financial instruments to the physical possession of the property. This factor has a significant advantage being there is weak price volatility, such as what happened in the gold industry in recent years. The material possession implies that diamonds are a tangible safe haven with no risk of total loss of money.

Diamonds are traded worldwide in 28 diamond exchanges with only one price-reference list, the Rapaport Diamond Report, and they are redeemable at anytime, anywhere in the world.

They are not subject to taxes, capital gains or statements. The investor is only subject to VAT at the time of purchase. With an invoice, diamonds are transportable and storable everywhere (and are not detected by metal detectors).

Unlike other investments, only diamonds can become at any time a wonderful jewel!

As with all goods, there are risks to be monitored:

– You have to buy a diamond at the market price, otherwise it will probably cause a loss at the time of resale. When you buy, you pay VAT, so an increase in the market value should cover this expense to obtain a capital gain.

– It is important to identify the type of diamond suitable for your expectations. Otherwise, at the time of resale, you have a risk of loss.

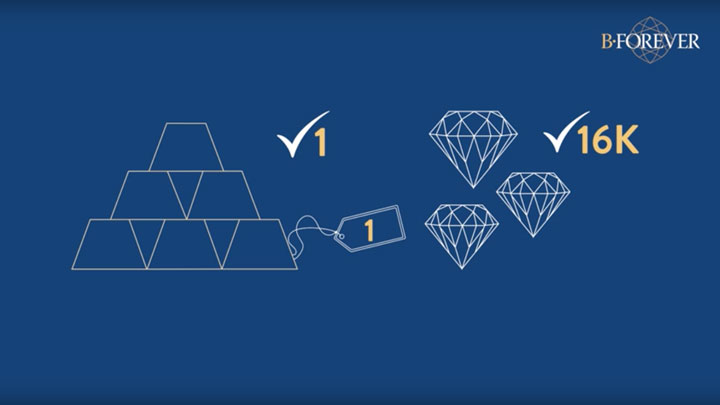

– If the purchase is concentrated in just one diamond, the sale will be more complex. Diversify – it is the golden rule for buying in diamonds too.